Regulatory disclaimer: past performance doesn’t guarantee future results and there is a risk of losing the invested money if the price decreases.

Not Financial Advice*

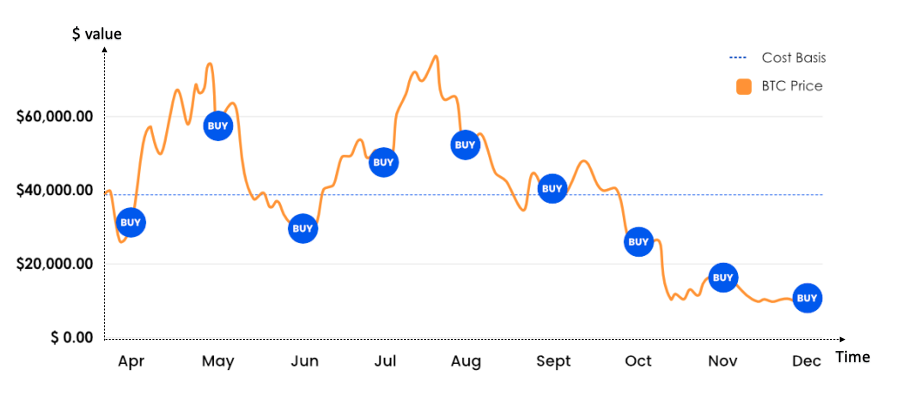

Dollar-Cost Averaging is an investment strategy that involves regularly purchasing a fixed Dollar amount -or Pound in the UK- of an asset, regardless of its price. This approach smoothens out the impact of price fluctuations over time. It reduces the emotional stress and guesswork associated with timing the market.

Benefits of DCA for Bitcoin Investors

Risk Mitigation: Bitcoin’s price is known to be volatile. DCA helps mitigate this risk by spreading your investments over time, reducing the impact of market fluctuations

Consistency: DCA installs discipline by encouraging regular investments. It avoid impulsive decisions driven by market hype or fear.

Reduced Timing Risk: Timing the market perfectly is impossible while you can “time in the market” with a DCA. “Buying the dip” can lead to indefinite waiting for the perfect moment.

Automatic Investment: your investment can be set on autopilot by sending recurring bank transfers making it a hassle-free & efficient.

Long-Term Accumulation: By steadily accumulating Bitcoin over time, you position yourself for long-term growth: adoption and value.

What are the relevant Risks ?

Like any trading strategy, it comes with its set of risks. Here are some relevant risks associated with DCA:

– No Guarantee of Profit: Market fluctuations and unpredictable events can impact the overall return on investment, especially if the asset lose its value or the price keep going down

Impact: Investors may not achieve the desired returns, and there is still a risk of financial loss.

– Dependency on Regular Cash Flow: DCA relies on a regular cash flow for consistent investments. If an investor experiences financial difficulties, they may not be able to maintain the strategy.

Impact: Disruption in the DCA plan and potential missed investment opportunities.

– Psychological Impact: DCA requires discipline, and investors may find it emotionally challenging to continue investing during prolonged market declines.

Impact: Emotional stress and potential for suboptimal decisions during market volatility.

Why Choose BitcoinPoint for DCA on Bitcoin?

Our user-friendly platform

makes it easy for both novice and experienced investors to setup banking orders weekly or monthly instantly converted.

Secure and Reliable

BitcoinPoint employs state-of-the-art security measures since 2018, providing you with peace of mind while you invest.

Supportive Community

Whether you have questions or need assistance, we are here to guide you.

Conclusion

We believe Dollar-Cost Averaging on Bitcoin is a prudent investment strategy –not financial advice– that ensures consistency, risk mitigation, and long-term growth.

Download the iOS App

and the Android App

*: Buying Bitcoin or any cryptocurrency involves risk and can result in losses of the invested capital. You should not invest more than you can afford to lose. Past performance is not indicative of future results. The average price might go down. Please ensure that you understand the risks involved. Investments in bitcoin or cryptoassets are not covered by the Financial Ombudsman Service or subject to protection under the Financial Services Compensation Scheme. Fees apply to transactions on BitcoinPoint and tax (including Capital Gains Tax) may be payable on any profits. BitcoinPoint do not make any recommendations in any transaction.

These materials are provided for informational purposes only and should not be considered as investment advice or a recommendation or solicitation to buy, sell, stake, or hold any cryptoasset or to pursue any specific trading strategy. BitcoinPoint expressly states that it does not engage in activities to influence the price of any particular cryptoasset it offers. It is important to note that certain crypto products and markets operate without regulation, and there is no protection under government compensation or regulatory schemes. The volatile nature of the crypto-asset markets carries the risk of financial loss. Tax obligations may arise from returns or increases in the value of your cryptoassets, and it is advisable to seek independent advice regarding your tax position.